What is a Company?- Definition, Characteristics and Latest Case Laws

Contents

A public business that had been registered as a private business earlier. In order to Convene a meeting, 2 or maybe more individuals must be present. Nevertheless, you will find specific circumstances where one person is able to constitute a legitimate meeting. The meeting have to be held at a specific place, time and day.

Accordingly, ‘corporation’ is a legal person created by a process other than natural birth. It is, for this reason, sometimes called an artificial legal person. As a legal person, a corporation can enjoy many of the rights and incurring many of the liabilities of a natural person. Every public company having share capital should convene a general meeting of shareholders within several not less than a single month and also no more than 6 weeks after the day where it’s authorised to commence its business enterprise. This’s the very first meeting of the shareholders on the business and it’s held one time in the entire life of the business. A company is treated as a separate legal entity from its member under the Companies Act, 2013.

CORPORATE MEETING

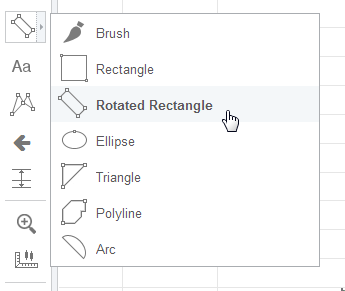

As company is an artificial person, it cannot take decisions by itself and requires decision of members and directs. Most decisions beyond the normal day-to-day running of a business willrequirearesolution. These also need to be passed for any decision which affects the constitution or rules of a company. There must be a minimum number of two directors for registering a private limited company.

After passing a resolution company is bound to act according to it. A private limited company name must have the words ‘private limited’ after its name. For example, if the company name is ABC, it must write its name as ‘ABC Pvt. Ltd’ in all its official communications and the company registration form.

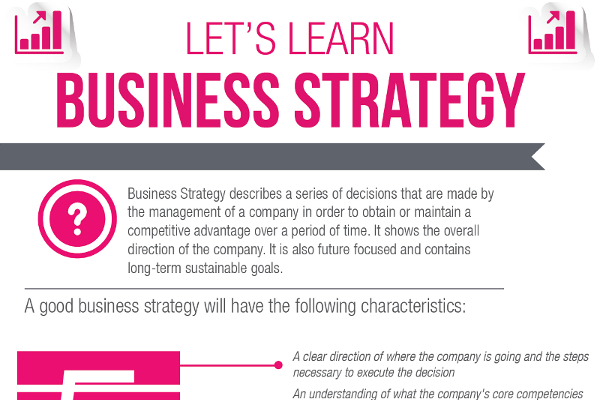

Definition of a company

The actions and objects of the company are limited within the scope of its Memorandum of Association. The Memorandum of Association of the company regulates the powers and fixes the objects of the company https://1investing.in/ and provides the edifice upon which the entire structure of the company rests. In the year 1850, the first Company enactment for the registration of the joint-stock company was introduced in India.

However, to avoid winding up, sometimes companies adopt strategies like reorganization, reconstruction, and amalgamation. A company is a body the characteristics of a company meeting are corporate, can sue and be sued in its own name. To sue means to institute legal proceedings against or to bring a suit in a court of law.

If the quorum does not complete within half an hour of the prescribed time, meeting will be adjourned to the same time, place and date in the next week. If at the adjourned meeting also the quorum does not complete, the members present shall be quorum and attending members may be allowed to come to a decision and pass resolutions. It means one member present in person shall constitute a valid meeting.

It did no business, but was created simply as a legal entity to ostensibly receive the dividends and interest and to hand them over to the assessee as pretended loans. A shareholder can transfer his shares to any person without the consent of other members. Articles of association, even of a public company can put certain restrictions on the transfer of shares but it cannot altogether stop it. Shareholders are not, in the eyes of the law, part owners of the undertaking. In India, this principle of separate property was best laid down by the Supreme Court in Bacha F. Guzdar v. CIT, Bombay . The Supreme Court held that a shareholder is not the part owner of the company or its property, he is only given certain rights by law, for example, to vote or attend meetings, or to receive dividends.

Characteristics/Features of a Private Limited Company

Whereas on the other hand, a company limited by shares is when members’ liability is limited to the unpaid amounts or shares they hold. Section 2 of the Citizenship Act, 1955 defines that a legal person is not a citizen and does not include a company or association, whether incorporated or not. So, from the Act, it is clear that a company cannot be a citizen. In the case of The State Trading Corporation v. Commercial Tax Officer , the Court held that the word “citizen” can only refer to a natural person and none other than that. Therefore, a company cannot claim citizenship to invoke fundamental rights under the Constitution of India. Company is required to take many decisions for growth of the business and to fulfil legal requirement of the laws.

- The advantages of incorporation are allowed to be enjoyed only by those who want to make an honest use of the ‘company’.

- Held that a director or managing director could not file a suit, unless it was by the company in order to avoid any deed which admittedly was executed by one of the directors and admittedly also the company accepted the rent.

- Accordingly, ‘L’ was an employee of the company and, therefore, entitled to compensation claim.

Only if they refuse to buy within the stipulated period that they can be sold to the outsiders. Mrs. Guzdar received certain amounts as dividend in respect of shares held by her in a tea company. Under the Income-Tax Act, agricultural income is exempt from payment of income-tax. As income of a tea company is partly agricultural, only 40% of the company’s income is treated as income from manufacture and sale and, therefore, liable to tax.

The DSC of a professional is required to complete the SPICe+ form. The professional should certify that the information provided in the form is correct. In case of rejection of the name, the company has to file another SPICe+ form with the prescribed fee. Perpetual succession means the company will continue to exist in the eyes of the law irrespective of insolvency, bankruptcy or death of any of its members. This is because of law students, advocates, judges and professors like you, who give me satisfaction, hope and the motivation to keep working.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

It is called a legal person because it can enter into a contract, own property in its own name, sue and be sued by others, etc. In essence, it is not human, but it acts through human beings. It is called an artificial person because it is invisible, intangible, and exists only in the vision of the law. A company being an artificial person, cannot make decision by its own. Shareholders are the owner of the company and directors are liable for the management of the company. Shareholders and directors are required to take decisions for day to day transaction and growth of the company.

8 Common seal*

So many different features a company possesses in the whole process. However, companies are called artificial persons since they are intangible, invisible, existing in the contemplation of law. Companies can also enjoy rights and are well versed in performing other duties. In common law, a company is a “legal person” or “legal entity” separate from, and capable of surviving beyond the lives of its members. However, an association formed not for profit also acquires a corporate character and falls within the meaning of a company by reason of a license issued under Section 8 of the Act. The nature of a company is that it is distinct from its members.

In simple words, a company is a business organization formed by an individual or group of individuals who work jointly to achieve a common goal or objective. Indian companies are formed and incorporated according to the provisions given under the Companies Act, 2013. All Indian companies are registered under the Companies Act of 2013 and work according to the procedure provided under this Act. The advantages of incorporation are allowed to be enjoyed only by those who want to make an honest use of the ‘company’. In case of a dishonest and fraudulent use of the facility of incorporation, the law lifts the corporate veil and identifies the persons who are behind the scene and are responsible for the perpetration of fraud.